Manfo Resource Project + Nkosuo Mining Lease

Highlights

-

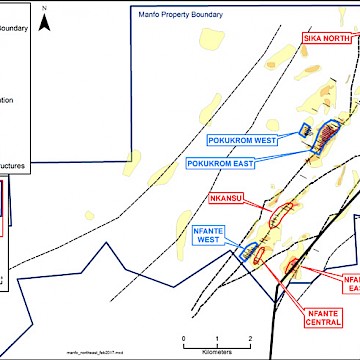

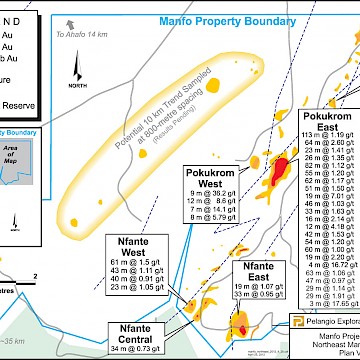

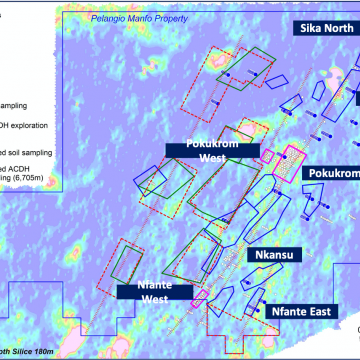

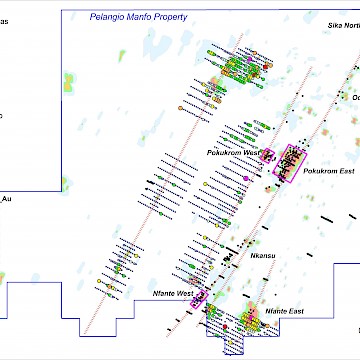

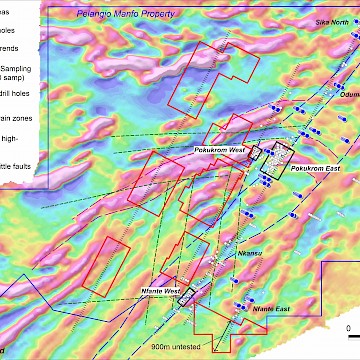

Pelangio has discovered seven near surface areas of gold mineralization along a 9-kilometre trend of multiple structures

-

three areas comprise the initial resource stage: Pokukrom East and West, Nfante West

-

Maiden resource estimate of 195,000 oz (at 1.5 g/t Au) Indicated, plus 298,000 oz (at 1.0 g/t Au) Inferred developed by SRK Consulting, in 2013

-

The Nkosuo license is a 30-year Mining Lease granted in September 2024 to Ghanaian company FJ Minerals Ltd. and is contiguous to the southern edge of the Manfo property.

-

Pelangio has entered into a strategic agreement with FJ Minerals to acquire up to an 83% interest in the property.

-

The Nkosuo lease adds 18 square kilometers of prospective geology to the Manfo project including 4 kilometres of strike extension of the Manfo mineralized trends to the south.

-

There are demonstrations of the Manfo mineralization continuing into Nkosuo with artisanal mining activity along the strike extension of the Pokukrom-Nfante West trend plus the Nfante Central prospect, and limited exploration by Ashanti Goldfields (in 2005) in the northern end of Nkosuo returned up to 37 meters of 1.5 g/t Au in an RC hole and 37 meters at 5.6 g/t Au in a trench 1.1 kilometers south of the Manfo property boundary.

Ownership

- 100% ownership

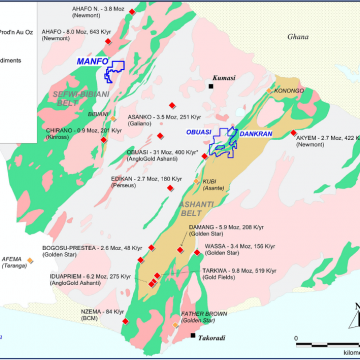

- 100 square kilometres on Ghana’s prodigious Sefwi Greenstone Belt

Property Details

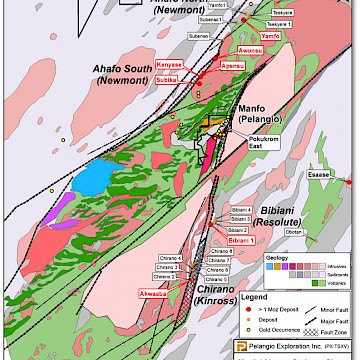

Pelangio’s Manfo project is situated roughly in the middle of the Sefwi-Bibiani Belt between Newmont’s Ahafo mine; the Subika deposit being only 14 kilometres to the NNE, and Resolute’s Bibiani mine 25 kilometres to the south of the Manfo project area and 50 kilometres from Kinross’ Chirano Mine. Similar to the Subika and Chirano deposits, the mineralization at Manfo is likewise hosted in granitoid intrusive rocks.

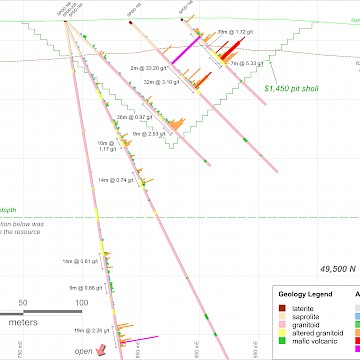

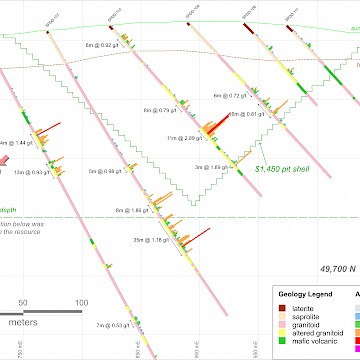

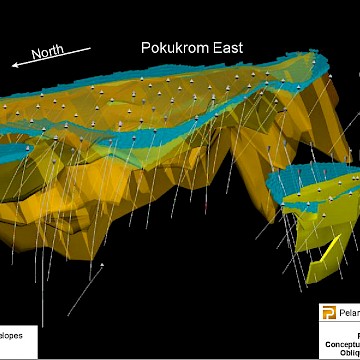

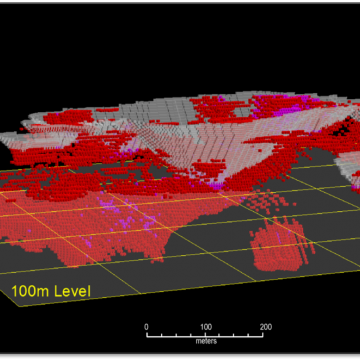

The Manfo property is underlain by metasediments, mafic metavolcanic rocks, and granitoid intrusive bodies. A major northeast trending fault zone or corridor, approximately three kilometres wide, traverses the east side of the property. This fault corridor serves as the regional contact between the greenstone volcano-sedimentary package to the west and a regional belt batholith to the east. Gold mineralization at Manfo is hosted in sericite and hematite altered granitoid rock adjacent to a set of brittle-ductile faults. Within the alteration envelopes, the gold mineralization occurs adjacent to the brittle-ductile faults, and in fracture-controlled zones preferentially developed in certain horizons within the granitoid in the hanging wall of the fault. Alteration and gold mineralization are closely related to increasing strain. Gold is associated with wide zones of pervasive to fracture-controlled quartz-sericite-carbonate-pyrite alteration overprinting an earlier phase of hematite alteration hosted predominantly in sheared and locally brecciated, altered granitoid rocks and to a lesser extent brecciated hematite-altered mafic metavolcanic rocks.

The 124 square kilometer Manfo-Nkosuo project is located near the centre of the Sefwi-Bibiani greenstone belt and overlies Paleoproterozoic Birimian metasediments, minor metavolcanics plus “Dixcove” or belt-type granite and sits on the western flank of a major north-northeast striking intra-belt crustal structure. The granite intrusive hosts the known gold deposits and prospects on the project with orogenic-type gold mineralization occurring in zones of fracture-controlled quartz-albite-sericite-carbonate-pyrite alteration in brittle to ductile deformed altered granitoid rocks. This style of mineralization is similar to that for the very large granitoid hosted Subika deposit in Newmont’s Ahafo South mine 13 kilometers to the north.

The Nkosuo license is a 30-year Mining Lease granted in September 2024 to Ghanaian company FJ Minerals Ltd. and is contiguous to the southern edge of the Manfo property. Pelangio has entered into a strategic agreement with FJ Minerals to acquire up to an 83% interest in the property. The Nkosuo lease adds 18 square kilometers of prospective geology to the Manfo project including 4 kilometres of strike extension of the Manfo mineralized trends to the south. There are demonstrations of the Manfo mineralization continuing into Nkosuo with artisanal mining activity along the strike extension of the Pokukrom-Nfante West trend plus the Nfante Central prospect, and limited exploration by Ashanti Goldfields (in 2005) in the northern end of Nkosuo returned up to 37 meters of 1.5 g/t Au in an RC hole and 37 meters at 5.6 g/t Au in a trench 1.1 kilometers south of the Manfo property boundary.

Several potential mineralized trends are evident on Nkosuo. Ashanti’s limited exploration plus the artisanal mining indicates the Pokukrom-Nfante West trend may extend for 2.2 kilometers strike into the Nkosuo property from the Manfo property boundary. Additional artisanal mining on strike with the Nfante Central prospect suggests a second mineralized trend 600-700 meters to the east, with a strike of at least 2.2 kilometers. And there appears to be one or two mineralized structures lying between these two main trends plus the possibility of one or two additional mineralized trends extending from Manfo into Nkosuo, e.g. an extension of the Nfante East prospect. There may be up to six mineralized structures extending from Manfo into Nkosuo which could host significant gold mineralization that might result in the Manfo-Nkosuo project yielding a much more substantial resource than is currently delineated on Manfo.

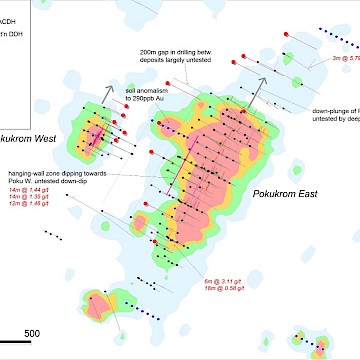

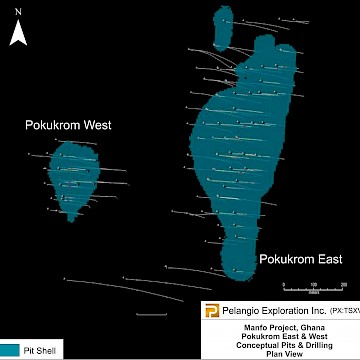

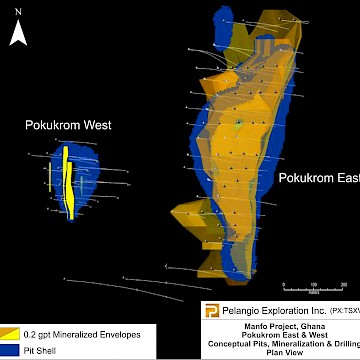

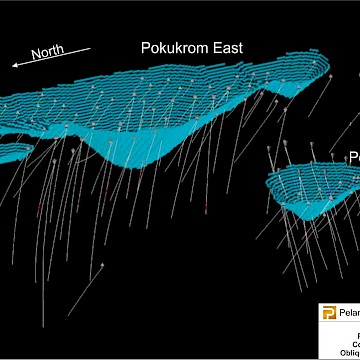

Pelangio has drilled a total of 339 exploration and resource delineation holes totalling 45,571 metres. Seven gold-mineralized areas have been identified to date, primarily along a prominent 9-kilometre long soil geochemical trend, on the eastern side of the project. The maiden gold resource at the Manfo project is contained within three deposits:

- Pokukrom East (PE);

- Pokukrom West (PW); and

- Nfante West (NW)

Pelangio’s technical team defined wireframes for the altered envelopes and submitted them to SRK for optimization using alteration profiles and lithological coding of drilling data. SRK considers portions of the Manfo gold mineralization amenable for open pit extraction. The “reasonable prospects for eventual economic extraction” were assessed using a pit optimizer. The mineral resources for the Manfo gold project are reported at two cut-off grades. The mineral resources within the oxide material are reported at a cut-off of 0.40 gram of gold per tonne (gpt gold), whereas the transitional and fresh portion of mineral resources are reported at a cut-off grade of 0.50 gpt gold, and a gold grade of US$1,450 per ounce was used in the estimation. The mineral resources were classified as Indicated and Inferred, primarily based on the basis of continuity at the reporting cut-off grade, positive kriging efficiency, situation within the conceptual pit envelope used to constrain the mineral resources and on variography results. Several mineralized zones remain open down dip beyond the limits of the conceptualized pits and the resource envelopes are open down plunge, providing an opportunity for resource growth with further drilling and demonstrated extensions of the mineralized zones, plus utilization of a higher gold price for the pit optimization and resource estimation.

Resource Estimate

This first resource statement for Manfo constitutes an important milestone in the long-term exploration strategy for Pelangio's gold properties in Ghana.

Mineral Resource Statement* Manfo Gold Project, Ghana – SRK Consulting (Canada) Inc., May 7, 2013

|

Category |

Cut-off |

Indicated |

Inferred |

||||

|---|---|---|---|---|---|---|---|

|

Quantity |

Grade |

Contained |

Quantity |

Grade |

Contained |

||

|

Inside Pit |

|

|

|

|

|

|

|

|

Oxide |

0.40 |

49 |

0.96 |

2 |

458 |

1.07 |

16 |

|

Transitional |

0.50 |

382 |

1.96 |

24 |

876 |

1.13 |

32 |

|

Fresh |

0.50 |

3,543 |

1.49 |

169 |

918 |

1.09 |

32 |

|

Total |

|

3,973 |

1.52 |

195 |

2,253 |

1.10 |

80 |

|

Outside Pit |

|

|

|

|

|

|

|

|

Oxide |

0.40 |

|

|

|

50 |

0.68 |

1 |

|

Transitional |

0.50 |

|

|

|

217 |

0.72 |

5 |

|

Fresh |

0.50 |

|

|

|

7,146 |

0.93 |

213 |

|

Total |

|

|

|

|

7,413 |

0.92 |

218 |

|

Combined Inside and Outside Pit |

|

|

|

|

|

||

|

Oxide |

0.40 |

49 |

0.96 |

2 |

508 |

1.05 |

17 |

|

Transitional |

0.50 |

382 |

1.96 |

24 |

1,093 |

1.05 |

37 |

|

Fresh |

0.50 |

3,543 |

1.49 |

169 |

8,064 |

0.94 |

245 |

|

Total |

|

3,973 |

1.52 |

195 |

9,666 |

0.96 |

298 |

*Mineral resources are not mineral reserves and do not have a demonstrated economic viability. All figures have been rounded to reflect the relative accuracy of the estimates. The cut‐off grades are based on a gold price of US$1,450 per ounce and metallurgical recovery of 94 percent for oxide, and 86 percent for fresh and transitional material. Mineral resources are reported in relation to an elevation determined from optimized pit shells. All composites have been capped where appropriate.

For further information on the Manfo property, please see the technical report, “Mineral Resource Evaluation Technical Report, Manfo Gold Project, Ghana for Pelangio Exploration Inc. by SRK Consulting (Canada) Inc.”, June 21, 2013.