Additional Properties

Kenogaming Polymetallic Project

Pelangio has entered in an agreement to purchase a 100% interest in the highly prospective, 178 hectare gold, silver, zinc polymetallic project in Kenogaming Township, located approximately 63 km southwest of the City of Timmins, Ontario.

Highlights Of the Kenogaming Project:

- The Kenogaming Project covers 800 m of strike length on an established 300 meter wide strongly pyritized corridor of highly altered felsic rocks that are geochemically enriched in gold and zinc.

- Significant gold and base metal mineralization has been intersected within this corridor by previous explorers.

- Highlights of historical drilling include intercepts grading 35.65 g/t gold over 1.21 meters, 18.5 g/t gold over 1.0 meters and 0.59 g/t gold, 1.8 g/t silver and 1.10% zinc over 10 meters.

- Minimal drilling has been completed below 150 vertical meters with approximately 400 meters of untested strike length.

- The Kenogaming Project is a drill-ready project.

- Permitting is underway for a fully-funded, 1,000-meter diamond drill program.

Agreement Terms

Pelangio has agreed to purchase a 100% interest in the Kenogaming Project by granting DSB Capital Corp. (“DSB”) a 1% net smelter return royalty and issuing to DSB 350,000 common shares in the capital of Pelangio. The Kenogaming Project is subject to an underlying 3% net smelter return royalty. Pelangio will have the right to buy-out 1% of the 3% NSR for $1,000,000. A wholly-owned subsidiary of Pelangio holds 70% of the underlying royalty.

“The acquisition of the Kenogaming project represents a cost-effective opportunity to augment our polymetallic project portfolio in Ontario. We look forward to drilling this highly prospective project once permits are received,” said Ingrid Hibbard, President and CEO.

Kenogaming Summary and Geological Description

In 1996, Eastmain Resoures Inc. conducted the last major drilling campaign on the adjoining Glencore patents and a few holes on the adjoining Kenogaming Project. Eastmain prospecting, geophysics and drilling demonstrated the presence of a strongly pyritized corridor of highly altered felsic rocks which are geochemically enriched in gold and zinc. This corridor was reported to have extended for approximately four km over a width of 300 meters. Approximately 800 meters of prospective strike length within this corridor is located on the Kenogaming Project. Coincident with the pyritized corridor and an associated alteration package of sericite, chlorite, silica and fushite is the historical Dunvegan gold, zinc occurrence. The original Dunvegan occurrence and a substantial portion of the known gold-bearing Dunvegan trend is now located within the Kenogaming Project.

Limited drilling by Eastmain on the Kenogaming Project demonstrated considerable gold and base metal potential associated with the Dunvegan trend. Eastmain drill hole EAK-96-20 returned 0.59 g/t gold, 1.8 g/t silver and 1.10 % Zn across 10 meters. A higher-grade intercept in Eastmain hole EAK-96-20 returned 18.5 g/t gold over 1 meter.

Prior to Eastmain’s work, Halley Resources Inc. completed a series of holes in 1988 on the Kenogaming Project. A number of holes were drilled on the Dunvegan trend. A highlight from Halley’s work on the Duvegan trend included an intercept of 35.65 g/t gold over 1.21 meters. More importantly, Halley found a second gold -bearing zone which was designated the “New Zone” (NZ). The NZ appears to lie in the footwall of Dunvegan Zone. Drilling on the NZ returned a number of significant drill hole intercepts including 20.57 g/t gold over 1.95 meters in hole H88-6, and 13.02 g/t gold over 0.61 meters in hole H88-1. (Note: All values reported are core lengths.)

With respect to new exploration potential, drilling to date for the most part has been focused above 150 meters vertical on the Kenogaming Project. More recent results by Eastmain and Halley suggest that there is excellent potential to increase metal grade and thickness on the known zones with further drilling at depth and along strike. Further, the discovery of the NZ below the Dunvegan Zone suggests there may be potential for other mineralized zones within the large alteration corridor noted by Eastmain geologists.

(References: Ontario Government Assessment Files for Eastmain Resourec Inc., Halley Resources Inc., Falconbridge Nickel Mines, Dunvegan Mines, and OGS Report 97 by V.G. Milne, 1972)

Future Plans

The Kenogaming Project is a drill-ready project. Pelangio will immediately apply for exploration permits and plans to conduct a minimum first-phase drill program of 1000 meters. This fully-funded program is designed to follow up on the strike and down dip extensions of both the NZ and Dunvegan Zones.

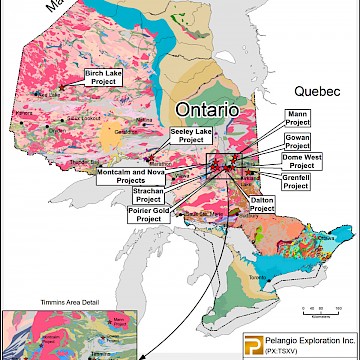

Seeley Lake

Pelangio owns 100% of the 760 acres Seeley (Lorna Lake) property and there is no underlying royalty. The Seeley property is located in the historic Hemlo area and is contiguous with the Wire Lake Property recently optioned by Canadian Orebodies Inc. During the Hemlo discovery era, Pelangio's initial diamond drilling returned an intercept of 4.7 g/t gold over 1 metre. The drill program was supervised by Kevin Filo, P. Geo., and assay certificates from Bondar Clegg were verified. The Hemlo area is again becoming one of the more active exploration regions in Ontario. Pelangio did not complete any exploration activity in 2018 and no activity is currently planned.

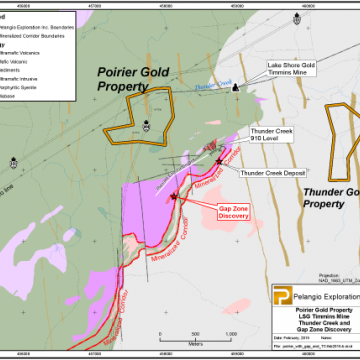

Poirier

Pelangio owns 100% of the Poirier Gold Property Lease (47.34 hectares) located in Bristol Township, 22 km west of Timmins, contiguous with Pan American Silver Corp.’s (previously Tahoe Resources Inc.) Timmins and Thunder Creek deposits (collectively, the Timmins West Mine). The property is subject to a 1% NSR (which may be purchased for $1 million) payable to the vendors and a further 1% NSR payable to a third party.

The Poirier Gold Property is underlain near‐surface by a mafic volcanic unit approximately one kilometre to the west of the mafic, ultramafic and sedimentary contact, which dips steeply westwards towards our lease and which is associated with the Thunder Creek Project. A 100 meter‐spaced geophysical program of ground magnetics and GPS was completed in 2015. In 2016, a three‐dimensional geologic model was prepared for project area using all available public data and combined with results of a three‐dimensional magnetic inversion received in the third quarter 2015. Combining three‐dimensional geology with the magnetic data indicates good agreement between magnetic data and a magnetic ultramafic rock overlying the deposit. This data indicates that the favourable structure hosting the Rusk and Gap zones dips into the Poirier ground. The interpretation of the ground magnetic survey has improved the understanding of the geological setting of the Poirier Gold Property. A review and evaluation of the potential of this property is planned for the future.

Depending on continued results from the Thunder Creek Project, we may conduct further exploration and drill on the property.

Thunder Gold

Pelangio owns 100% interest in the Thunder Gold property located 20 kilometres west of Timmins, Ontario. It consists of one lease (48.5 hectares) which was converted from three claims in 2010 and holds an underlying royalty of 2% and $1,000 per year advance royalty to the vendors.

Mann Property

The Mann property is located in Mann Township 50 km northeast of the City of Timmins and covers an area of approximately 2 km2. The patented claims cover a portion of a large ultramafic complex that is prospective for nickel, copper and cobalt. Some historical untested EM anomalies are present on the property. No recent work of significance has been conducted on the property.

Black Township

Pelangio owns 100% interest in the Black Township property located 100 kilometres east of Timmins, Ontario. It consists of two claims which were staked in 2010, and holds no underlying royalty.

Dalton

The Dalton Property is located 1.5km southwest of the Hollinger Mine in the Abitibi Greenstone Belt, the largest greenstone belt within the Canadian Shield. Newmont Goldcorp is currently operating a surface open pit at the former Hollinger site. The Abitibi Greenstone Belt is the most prolific Archean terrain in terms of copper-zinc sulphide mineralization and gold mineralization. Major east and northeast trending faults (the Destor-Porcupine Deformation Zone and the Cadillac Deformation Zone) were active through the main period of volcanism. Over 120 million ounces of gold have been produced from mines associated with these two major structures in the Timmins, Kirkland Lake and Holloway gold camps. The Destor Porcupine fault is located approximately 2 km south of the property. Pelangio currently controls 10% interest in the Dalton property.

Royalties

Pelangio also owns the following royalties in a number of Canadian properties as shown in the table below:

| Matheson West and East | 1% NSR can be purchased by Matamec Explorations Inc. for $1,000,000 and 100,000 common shares of Matamec |

| Mord | 1.5% NSR (provided Pelangio exercises right to buy back 1% for 100,000 shares of Pelangio) |

| Ross/Guibord | 1% NSR |

| Montcalm & Nova | 1.25% NSR with 50% buy back |

| Grenfell | Right to buy back 0.50% NSR from original vendors |

| Horden Lake | 0.80% NSR |

| Kidd Township | 2% NSR - Galleon Gold has right to buy back 1% for $1 million |

| Poirier Property Bristol Twp. | Right to buy back 1% NSR for $1 million |

| Clergue & Dundonald | 1% NSR on six mining leases |

| Kenogaming Twp. | 2.1% NSR with right to buy back 0.70% for $700,000 |